Further discussion on the effects of damage caps on malpractice claims in Florida

Gallagher Healthcare :: Industry Insights

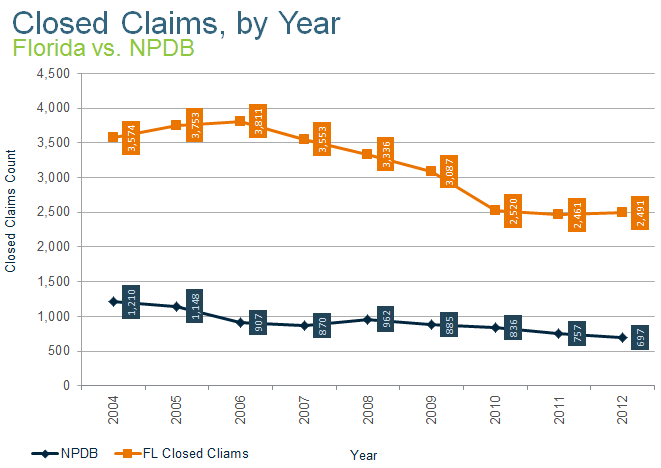

By Trey Hutchins | 5/7/2014In my last blog post, I took a look at how the passage of tort reform in Florida has changed the number of paid claims for physicians in the state. In summary, analyzing the data provided by the National Practitioners Data Bank (NPDB) showed a clear decline in the number of paid claims against physicians in Florida. The information provided by the NPDB is some of the most comprehensive data we have on claims; however, the state of Florida also tracks malpractice claims and it would only be fair to review this data too. In the decision to overturn the cap on death cases, Justice Lewis references data from the annual report on medical malpractice closed claims and rate filings from the Florida Office of Insurance Regulation.

First, let’s discuss the differences in these data sets we will be examining. The NPDB is a public database that only tracks paid claims against physicians. Payments made on behalf of a hospital or multi-owner medical group are not currently reported, nor are claims that do not have a payment to the plaintiff. Therefore, there will be many claims that are not reported to the data bank. The report provided by the Florida Office of Insurance Regulation tracks all claims, therefore the numbers will be higher since many claims are resolved without any payment. However, what I wanted to see is how the two sets of data correlate to each other. The simple hypothesis would be that the passage of tort reform (damage caps) would lead to fewer claims being filed against physicians. This should lead to a decline in both overall claims (tracked by the state) and paid claims (tracked by the NPDB). To further hypothesize, I would think there will be a larger reduction in filed claims when compared to paid claims, based on the theory that damage caps will reduce frivolous lawsuits.

The other significant difference between the two data sets is the time period that is tracked. Unfortunately, the data from the state of Florida has only been tracked since 2004. Therefore it does not give us a clear picture of how many claims were being filed prior to the passage of tort reform. So while the NPDB gives us data from 1991 to 2013, the information provided by Florida only covers 2004 to 2012 (2013 should be released later this year).

As you can see from the image below, there were significant reductions to both filed claims and paid claims in the time period following the passage of tort reform in 2003. Probably the most substantial difference in the two data sets is that the Florida data (that tracks all claims) continued to increase in years 2004–2006 before declining 2007–2011, while closed claims with payments had decreases every year from 2004 to 2007. There was a small increase in 2008 before continuing to decline from 2009 to 2012; however, the largest decreases were seen between 2004 and 2007. Some of this is probably owing to the lag time between when a claim is filed and when it is closed—averaging around 18 months on a national basis. Let’s briefly discuss that before going through the numbers.

Generally, there are 3 types of claim—claims that are eventually dropped, claims that are settled and claims that are taken to court. Yes, this is a broad, high level overview, but for conversation purposes I will quickly summarize each type of claim listed above.

Many claims are dropped shortly after being filed. While I’m sure there are various scenarios, probably the most common is that the plaintiff attorney determines the case is not worth their time. There are also many claims that are settled prior to going to trial. There are many reasons a case would be settled including, but not limited to, the medical case doesn’t support the defense, actual medical error, no medical error, but a case that would be very difficult to win in court (death of a baby or child) and sometimes where the actual damages are too small to justify fighting (it cost less to pay out than it would to take it to court). Often these claims drag on as the attorneys try to negotiate the best settlement for their clients, but are closed before the case actually goes to trial. As can be expected, some cases actually make it to the trial, but these are generally won by the defense (physician) 85–90% of the time. Insurance companies are very selective of the cases they will take to trial—therefore, they win the majority that they choose to take to court.

Even based on the fact that there is a substantial amount of time between a claim being filed and a claim being closed, my initial hypothesis was incorrect. The number of closed without payment cases did not decrease more than the number of paid claims. In fact, looking at the numbers, it would appear that initially tort reform did not have much of an impact on the number of claims filed. However, it did have a substantial impact on the number of claims that are paid (as tracked by the NPDB). Given a longer time it does appear that it also reduced the number of claims that were filed in the state. I’m not sure if this is owing to plaintiff attorneys holding out hope that it would be overturned, or if they were just slow to understand the change in the market. My guess would be they were holding out hope that tort reform would be overturned.

We must also take into account that we do not have the number of total claims closed prior to 2004, so there may have been an initial reduction in the number of claims starting at that point.

In conclusion, both sets of data show very clearly that both the total number of claims and the total number of claims with payouts have significantly decreased since the passage of tort reform. Given the lag time between claims being filed and claims being closed, it will be years before we are able to determine how the caps being overturned will affect the market. The other item that will be closely watched is the damage caps in regards to personal injury. The McCall Decision was specific for death cases, but most in the industry would expect caps on personal injury cases (malpractice cases that do not involve a death) to be overturned too.

So what does this mean for Florida physicians? As of right now, there has not been much change in the state. We have not seen any carriers increase rates and we have not heard of any carriers planning to exit the market. However, we will keep a close watch on how this change affects carriers with substantial exposure in the state, as this could cause problems. The rates in force at this time take into account the caps that protect the carriers. Now every open death claim in Florida no longer has that protection, and it is assumed that the same could happen soon for personal injury cases. I highly recommend that physicians practicing in Florida find an insurance broker that is specialized in physician practices and monitors each carrier’s financial health. In the event that claims start moving back to the pre-tort protected averages, current rates are not sufficient and could lead to solvency issues.