What to learn from a carrier’s combined ratio

Gallagher Healthcare :: Industry Insights

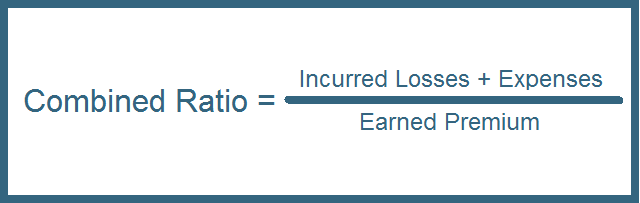

By Gallagher Healthcare | 1/6/2014The combined ratio is an important aspect of any insurance carrier that brokers study in order to better service their clients with their medical malpractice insurance policy. Before we demonstrate what to look at when studying this ratio, we will first explain how it is calculated.

Losses refer to the payments for claims that have ended in settlements or judgments. This tends to be the most focused-on part of the equation because a company’s loss ratio can be very difficult to correct. This number reflects on who the company has offered coverage to and how well they have performed. If a carrier agrees to insure any physician who asks for coverage, that “bad business” will be followed by claims, resulting in some shape or form of payment. A high loss ratio will continue to plague the finances until the carrier starts to insure different physicians or raise the prices of their premiums.

The other part of the equation is the expenses, which represent how well the company spends their money. If a carrier is just starting out, expenses will normally be high in the first few years. This can be due to renting out multiple office locations, buying office equipment, and hiring new employees. If the company still has high expenses in the ongoing years, this is sign of improper management and insufficient underwriting. A company should always ask themselves, are we writing risk at the right cost? Are our premiums high enough to compensate for the level of risk that we are taking by covering these physicians? Expenses are the easier to fix of the two components because a company can readjust the numbers by cutting back on employees, slowing down how quickly they spend, and choosing what they are spending their money on.

Even though a combined ratio does not include a company’s investment returns, which means that they can manage to stay afloat, they should still have relatively decent loss and expense ratios. The combined ratio is very important because it shows the viability of a carrier in a snapshot. A perfect ratio is close to the .9-.95 range, but if a company is anywhere near those numbers and below 1, this demonstrates that the carrier is running a fairly successful business. Any ratio over 1 signals that more money is being spent to pay off claims or company expenses than to retain incoming premiums. This gives way to thoughts of future insolvency if that number continues to grow. A ratio that is less than 1 shows profitability, as for every dollar coming in, only a percentage of it is being used. If a company has a ratio lower than .5, it usually means that they are charging too high of premiums or they have lots of money on reserve. In the end, a physician should not choose an insurance carrier based solely on their combined ratio, but it is important to think about which will charge them an appropriate premium as well as whether they will still be in business 20 years from now in order to support them in a claim.