As a physician, your top priority is providing care to your patients. But neglecting to meet your insurance needs can have a direct impact on your ability to practice medicine effectively. Regardless of how much you pride yourself on your professional expertise, do not assume you're safe from a malpractice claim. According to the American Medical Association, more than 65 percent of doctors age 55 or older have been sued for malpractice at least once.

Surgeon Malpractice

General surgery and OB/GYN physicians are the most likely to be sued, as 50 percent of physicians in these specialties report that they have been sued two or more times. The top five states for malpractice payouts are New York, Pennsylvania, California, New Jersey and Florida.

Common Allegations

The Most common malpractice allegations are:

- Missing or delayed diagnosis

- Negligent prenatal care

- Negligence during childbirth

- Medication errors

- Anesthesia errors

- Surgery errors

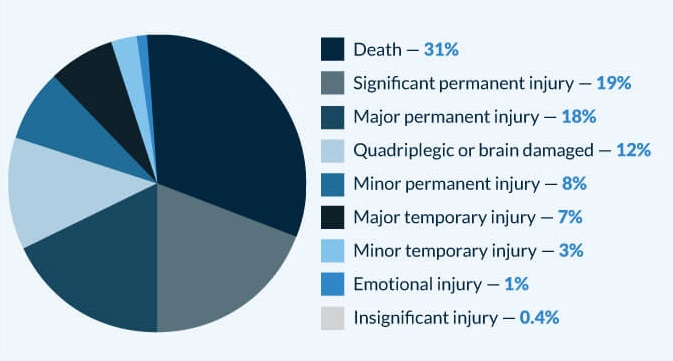

Common Claim Categories

Malpractice claims typically focus on a death or serious injury, but even relatively minor problems can result in an expensive and time-consuming claim that reduces a physician's ability to treat his or her patients. Here's how the malpractice claims listed in the National Practitioner Data Bank public use data file break down:

- Death — 31%

- Significant permanent injury — 19%

- Major permanent injury — 18%

- Quadriplegic or brain damaged — 12%

- Minor permanent injury — 8%

- Major temporary injury — 7%

- Minor temporary injury — 3%

- Emotional injury — 1%

- Insignificant injury — 0.4%

How to Choose Medical Malpractice Insurance: Don't Make These Common Choices

Poor medical malpractice insurance coverage can result in thousands of dollars in unnecessary premiums. You might also be forced to settle despite having a legitimate chance at winning a case and protecting your professional reputation.

Here are the most common mistakes physicians make when choosing their coverage:

1. Not Understanding the Lingo

Insurance, like medicine, has its own lingo. Consider this glossary of important terms you'll see when buying professional liability insurance for medical doctors:

- Admitted Carrier: An admitted carrier is an insurance company licensed and regulated by your state department of insurance. When you are insured through an admitted carrier, you are protected by your state's guarantee fund. This means that you are protected in the event your insurer unexpectedly declares bankruptcy and you have an open claim.

- Annual Aggregate Limit: For a claims-made policy, this number refers to the maximum dollar amount the carrier will pay during the year. This includes all covered claims, which means your aggregate limit is greatly reduced if you have multiple cases to settle at one time.

- Consent to Settle Clause: This clause states that your insurance carrier can't settle a claim without your written consent. If your policy doesn't contain this clause, you run the risk of your carrier settling a claim that has no merit simply because the settlement is less costly than a full defense.

It may be in the insurer's best interests to keep costs down, but a settlement to an unwarranted claim can adversely affect your professional reputation as well as your ability to obtain future malpractice insurance coverage. However, even if your coverage contains a consent to settle clause, exceptions may be included — for example, you might be expected to waive the right to consent if the settlement happens after you're no longer practicing medicine or once you're no longer insured by the carrier.

- Cyber Liability Coverage: This coverage protects you against liability due to technical issues like data being compromised by a disgruntled employee, security breaches caused by hackers, virus-related problems or identity theft. It can also provide protection against liability relating to HIPAA or HITECH Act violations.

- First Dollar Coverage: This means you have no deductible and zero out-of-pocket expenses relating to a claim.

- Hammer Clause: A hammer clause forces you to comply with your carrier's decision to settle a claim, regardless of its merit. If you refuse to settle, you're responsible for any costs incurred above the settlement amount. For example, if the plaintiff in a case wants $75,000 to settle a claim and you refuse to accept the offer despite your carrier's request to do so, you're personally liable for any judgment awarded in excess of the $75,000 when the case goes to trial. Ignoring a hammer clause opens you up to a serious financial risk.

- Locum Tenens Coverage: This type of coverage lets you use a substitute physician to temporarily perform your duties without affecting your coverage as long the carrier is properly notified of the physician's name and dates in which he or she will be assuming your duties. Locum tenens means "place holder" — indicating that the physician is only filling in due to vacation, illness or sabbatical.

- Non-Admitted Carrier: A non-admitted carrier is an insurance company that is not licensed or regulated by your state department of insurance. When you are insured through a non-admitted carrier, you lack the protection of being covered by your state's guarantee fund. However, a non-admitted carrier can be a viable option if you require excess & surplus lines coverage.

Not understanding key terms can leave you with a policy that provides inadequate coverage. Depending upon the circumstances, you may also end up inadvertently damaging your professional reputation.

Consider the following scenario:

Dr. Dawson is sued by the family of Mr. Miller, a recently deceased patient, for a failure to diagnose and treat lung cancer in a timely manner. When purchasing his medical malpractice coverage, Dr. Dawson failed to notice that his policy did not have a consent to settle clause. His insurer decides to settle the case after determining that litigation would be too costly. The hammer clause in the policy forces Dr. Dawson to settle the claim, despite his belief that Mr. Miller's condition could not have been diagnosed earlier.

The settlement is required to be reported to the National Practitioner Data Bank, resulting in problems when Dr. Dawson tries to relocate to Oregon with his wife and finds himself unable to obtain hospital privileges or state licensure.

Avoid finding yourself in Dr. Dawson's shoes by taking the time to learn common malpractice coverage terms and seeking the assistance of an advisor from Gallagher Healthcare.

2. Making False Assumptions About Your Coverage

When considering any type of insurance policy, never assume you're covered for anything. Ask for a complete copy of your malpractice insurance policy and all applicable endorsements for your records. Read these documents carefully and ask your broker for clarification if needed.

A common mistake doctors make is not realizing that they're only covered for certain procedures. Your malpractice insurance rate is determined based on your specialty and the level of risk it involves. If you neglect to state all of the procedures you perform regularly or if one is accidentally omitted on your application, you risk a denial of coverage or a cancellation.

If you wish to begin performing additional procedures, you must first contact your insurer and obtain written confirmation that the terms of your coverage have been altered. Failing to do this leaves you open to serious legal problems if something goes wrong while you are treating a patient.

Ignoring policy exclusions can also land you in hot water. For example, coverage commonly excludes benefits for cases relating to libel, slander, sexual misconduct or criminal acts. Issues related to fee disputes are usually not covered, since they are considered a contract issue as opposed to a valid malpractice claim. Your policy may also exclude services performed on a volunteer basis or have territorial restrictions that limit your ability to see patients who are visiting from another state.

Consider the following scenario:

After establishing a successful independent family practice center, Dr. Gray decides to give back to her community by volunteering to treat patients at a local clinic for low income families. She assumes that her current malpractice insurance covers this volunteer work, but her policy actually only covers the volunteer medical service she provides in the event of an emergency situation such as a car accident or natural disaster.

When she is sued for writing the incorrect dosage on a patient's prescription and causing a serious allergic reaction, she discovers that the clinic does not have adequate coverage either. She is left paying out of pocket to defend herself against the claim.

Here's another example of a situation where failing to understand policy exclusions can cause problems:

To better meet the needs of his patients, Dr. Raley provides consultations via email or telephone. He meets briefly with a patient who is now attending college out of state, diagnosing the young man with the flu after listening to a short description of his symptoms. Later, the patient is admitted to a local hospital and diagnosed with meningitis.

The delay in treatment causes permanent brain damage and Dr. Raley is sued for malpractice. His insurer denies coverage for the claim, citing a territorial restriction to Dr. Raley's policy. Paying the related expenses out of pocket forces Dr. Raley into an early retirement.

When you meet with a trusted advisor, you will have the terms of your coverage explained in detail. This prevents you from accidentally opening yourself up to an uncovered malpractice claim.

3. Leaving Gaps in Your Coverage Dates

Typically, medical malpractice insurance is written on a claims-made policy form. This means that a claim is only covered if the adverse incident occurred after the policy's retroactive date and it is reported while the policy is in effect.

If you drop a claims-made policy, you must purchase an extended reporting endorsement. This is also known as tail coverage and is designed to protect you from any claims that might arise later. Patients do not always uncover problems immediately and there may be a significant lag time between the date medical care is received and the date a lawsuit is filed. According to David Goguen, J.D., the average patient waits 16.5 months before filing a malpractice lawsuit and takes an average of 27.5 months to resolve the case.

The downside to tail coverage is that it can be costly. Instead, you might be able to obtain prior acts coverage or nose coverage as part of your new policy to provide protection for delayed claims that might result from the previous policy. Employers sometimes provide this coverage to physicians as part of a new job offer, but this is not guaranteed.

Consider the following scenario:

Dr. Hoover is an obstetrician insured with a claims-made policy that includes prior acts coverage dating back to January 1, 2005. Her policy expired on December 31, 2014. In August 2015, she receives notification of a lawsuit being filed relating to a delivery she performed in October 2013. The infant was later diagnosed with a severe neurological impairment. Unless Dr. Hoover has obtained tail coverage or a new policy with prior acts coverage, she will be considered uninsured for this claim.

Just as a patient with gaps in his or her health insurance coverage may experience difficulty getting necessary treatment approved, gaps in your malpractice coverage are likely to create unnecessary headaches. Gaps are especially risky for surgeons, who are listed as defendants in half of all medical malpractice trials, according to Goguen.

If you're changing positions or switching carriers, a trusted advisor can work with you to guarantee continuous malpractice coverage. Don't risk opening yourself up to an expensive and time-consuming claim!

4. Opening Yourself up to Vicarious Liability Claims

Vicarious liability is a form of secondary liability that is sometimes referred to as imputed negligence. This legal doctrine assigns responsibility for a claim to someone who did not cause the damage, but has a legal relationship with the person who did.

In the context of medical malpractice, vicarious liability becomes a problem when you share office space with a fellow physician. Having different business cards, different patient information websites and separate names on your doors isn't necessarily enough to keep the general public from assuming you are related business entities. It's quite possible that you could be held liable for a malpractice claim relating to the other physician's work even if you never treated the patient yourself.

Consider the following scenario:

Dr. Smith rents space to Dr. Yang. After six months, Dr. Yang is sued by a patient. The plaintiff also names Dr. Smith in the suit, assuming that Dr. Smith and Dr. Yang are related entities. Dr. Yang's insurer denies coverage for the claim, stating that it was procedure not listed on his policy application. Dr. Smith's insurer denies the claim on the basis that his policy was not designed to include this type of risk.

Despite having no direct involvement in the patient's care, Dr. Smith now has a claim on his record. To protect his professional reputation, he incurs $30,000 in legal fees to have himself removed from the claim.

Vicarious liability may also become a problem if you intend to hire a second physician to assist with your practice. Employers have a legal responsibility for the conduct of their employees. Regardless of the industry, an employee is considered to be acting as an agent of his or her employer. If you plan to hire a physician to assist you, it's crucial that you speak with a broker to about how to choose medical malpractice insurance that will protect you from vicarious liability claims.

For example:

Dr. Avery hires a second physician, Dr. Barnett, to assist with patient care during her maternity leave. During this time, Dr. Barnett fails to diagnosis a young woman's ectopic pregnancy. Dr. Avery is considered liable for the claim due to the employer-employee relationship between the two physicians. She was on leave at the time, but her responsibility as an employer was to ensure that Dr. Barnett had the skills necessary to continue in her absence.

The best way to avoid a vicarious liability claim is to be upfront about your insurance needs when meeting with your advisor. An experienced advisor can help you choose coverage that will provide the protection you need if you're renting out office space or hiring a second physician for your practice.

5. Searching for the Cheapest Deal on Your Own

Trying to keep your malpractice insurance payments under control is a smart move. However, you don't have the specialized experience necessary to shop for coverage on your own. Insurance, like medicine, is a field with its own terminology and specific professional practices. Shopping for insurance isn't something you can simply do on your lunch break or before you head home for the evening.

Buying professional liability insurance from a broker allows you to focus on maintaining your medical practice while ensuring you have the right coverage for your needs. A skilled broker can direct you to insurers who can offer deals that fit your medical specialty and risk profile.

When working with a broker, you'll receive policy proposals from two to four carriers as well as a detailed analysis outlining the potential advantages and disadvantages of each coverage option. Your broker can answer any question you might have about the process, including:

- How much medical malpractice insurance do I need?

- If I'm sued, does the carrier cover my defense costs? If so, are the defense costs included in the overall policy limits?

- What law firm will the carrier use if I have a claim filed against me? What is this firm's track record in regards to medical malpractice cases?

- Are there any discounts I might qualify for, such as a credit for transitioning from full-time to part-time employment?

- Are there any new careers that have entered the marketplace that might be able to offer a better deal for my specialty?

An experienced broker can also play a vital role if you've had a past malpractice claim and are now searching for new coverage. Your broker can explain the circumstances to the underwriter to ensure that you're not unfairly penalized for a claim that was settled without any concrete evidence of wrongdoing on your behalf.

Consider the following scenario:

Dr. Lopez is worried about keeping his expenses in check as he establishes a solo practice. Even though he's had a previous malpractice claim against him settled out of court, he decides to purchase medical malpractice insurance on his own. After doing 20 minutes of online research, he purchases the first policy that fits within his budget.

Nine months later, his budget carrier goes belly up. He's forced to scramble for replacement coverage and ends up paying a substantially higher premium. To make matters worse, Dr. Lopez discovers that his budget insurer was not an admitted carrier. This means he can't rely on the state's guarantee fund to pay any unpaid claims, leaving him at risk of financial ruin if he ends up being sued by a former patient.

With a broker's help, Dr. Lopez would have been able to obtain coverage from a financially stable carrier, regardless of his past claims history. If Dr. Lopez had enlisted the help of an experienced broker, his broker would have used one of the three best known insurance rating agencies — AM Best Company, Standard & Poor's or Weiss Ratings — to determine the financial health of the company.

A broker would have also stressed the importance of choosing an admitted carrier, since many hospital bylaws now require that a physician be insured by an admitted carrier before being granted admitting privileges.

To get the help you need, contact Gallagher Healthcare. Our advisors can assist you in your search for new coverage no matter where you are located within the United States. As the country's largest provider of professional liability insurance, we secure coverage for solo practitioners, stand-alone medical clinics, and physician groups. Our client base includes over 60 thousand healthcare providers and more than one thousand different medical institutions.

Gallagher Healthcare maintains partnerships with all major carriers and our large client base allows for better pricing within each market. In fact, physicians who switch to Gallagher Healthcare for their medical malpractice coverage needs save 20 to 50 percent on average.

Complete our online quote request form to learn more about how Gallagher Healthcare can help you navigate the insurance marketplace. You can also call us at 800.634.9513 and ask to speak to a salesperson directly.