Indiana Medical Malpractice Insurance

As one of the first states in the nation to implement statewide medical malpractice reform and the first to establish a state Patient Compensation Fund via the Medical Malpractice Act of 1975, Indiana has seen significant improvement in the areas of medical malpractice insurance rates and patient access to care since the passage of reform legislation. This law, passed in response to the withdrawal of all but two liability carriers from the state of Indiana between 1970 and 1975 and the average premium increasing by 410% annually, has provided a more stable medical liability climate over the past several decades.

Indiana Medical Malpractice Insurance Fast Facts

Doctors who are new to Indiana often have questions about medical malpractice insurance in the state. The following are some of the commonly asked questions about malpractice insurance in Indiana.

1. Does the Law Require You to Carry Malpractice Insurance in Indiana?

Indiana law requires physicians to obtain a minimal amount of insurance coverage to qualify for the state liability reforms. If you want to partake in an Indiana program designed for assisting physicians with claims, you'll need to carry a minimum level of malpractice insurance.

2. How Much Malpractice Insurance Do I Need in Indiana?

Aside from the minimum amount of coverage to qualify for state liability reforms, you'll want more coverage if you practice in a high-risk specialty, like surgery.

3. How Much Are Indiana Malpractice Insurance Rates?

How much is malpractice insurance in Indiana? Insurance rates in Indiana depend on your county, specialty, coverage amount and history of claims. A larger amount of coverage, for example, will cost more than a minimum amount of coverage.

Tort Reform in Indiana

The state's Medical Malpractice Act established the Indiana Patient Compensation Fund, which functions as an excess layer of coverage for each enrolled or qualified provider and also provides a cap on recoveries. Enrollment is voluntary in Indiana and requires payment of an enrollment surcharge to the Fund and proof of underlying coverage. Individual providers must carry primary medical malpractice insurance of $400,000 / $1.2 million (increased effective July 1, 2017, from the previously required limits of $250,000 / $750,000) and facilities generally must carry $400,000 / $8 million (also increased effective July 1, 2017, from the previously required limits of $250,000 / $5 million). The Fund will pay amounts exceeding the primary layer up to $1 million, capping total liabilities per claim at $1.65 million. All cases must pass through a medical review panel before being heard in court.

Top Carriers in Indiana

The following are some of Indiana's top carriers of medical malpractice insurance:

- ProAssurance

- Medical Protective Company

- Clarian Risk Retention Group

- State Farm Fire and Casualty Co.

- Cincinnati Insurance Company

- Indiana Residual Malpractice Insurance Authority

You can select from multiple carriers we partner with at Gallagher.

Statute of Limitations

The statute of limitations on a malpractice insurance claim in Indiana is two years, except for minors under the age of 6 (until 8th birthday to file) and certain exceptions made for previously unknown injuries discovered after two years.

Contributory Negligence

For suits brought against qualified providers (providers enrolled in the state patient compensation fund), contributory negligence on behalf of a patient is a valid defense and can preclude any potential recovery. However, in instances where the defendant in question is not a qualified provider, a patient's contributory negligence must exceed 50% of the total fault to prohibit recovery.

Joint and Several Liability

In claims brought against qualified providers (providers enrolled in the state patient compensation fund), defendants are considered jointly and severally liable as qualified providers fall outside of the scope of the Comparative Fault Act. For defendants covered by the Act, proportional liability is allocated based on each defendant's respective fault, and judgments are granted accordingly.

Vicarious Liability

Indiana allows a facility to be held liable for the negligence of an independent contractor under the theory of apparent agency. In instances where the negligent party is a qualified provider and working as an agent or employee of another qualified provider, only one damage cap is available for recovery, rather than one for each defendant.

Damage Cap

There is a cap on recoveries against qualified providers of $250,000 for the provider and an additional $1 million in excess provided by the patient compensation fund, with the ultimate cap culminating at $1.25 million. There is no cap on damages for unqualified providers.

Limitation on Attorney's Fees

For cases brought against qualified providers, attorney's fees cannot exceed 15% of the award amount. No cap exists for non-qualified providers.

Why Partner With Gallagher in Indiana?

For the best possible medical malpractice insurance terms, partner with Gallagher in Indiana. Tired of dealing with a computer to find or obtain insurance? With Gallagher, you'll speak to an expert who understands malpractice coverage in Indiana.

Partnering with us at Gallagher is the best way to obtain the most favorable terms for your malpractice insurance coverage. We manage the task of finding an insurance provider and negotiating rates, so you don't have to.

Resource for Physicians in Indiana

If you want to work as a physician in Indiana, you should obtain a medical malpractice insurance policy. Malpractice insurance will allow you to qualify for Indiana's state programs designed to assist physicians with claims and be able to practice at facilities that require coverage.

For medical malpractice insurance coverage in Indiana, contact us at Gallagher or request a quote today.

Indiana Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 250,000/750,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Family Practice No Surgery | $6,236 | $4,844 | $7,494 | 3,326 |

| Occupational Medicine | $4,317 | $3,365 | $5,551 | 1,824 |

| Internal Medicine No Surgery | $6,466 | $5,329 | $7,494 | 1,728 |

| Emergency Medicine | $12,608 | $9,893 | $14,807 | 1,095 |

| Anesthesiology | $6,954 | $5,814 | $8,238 | 1,094 |

| Pediatrics No Surgery | $5,335 | $4,038 | $6,731 | 915 |

| Radiology - Diagnostic | $7,290 | $5,814 | $8,413 | 813 |

| Obstetrics and Gynecology Major Surgery | $28,209 | $22,206 | $33,653 | 731 |

| Psychiatry | $4,318 | $3,391 | $5,384 | 624 |

| General Surgery | $20,147 | $16,471 | $23,981 | 497 |

| Orthopedic Surgery No Spine | $16,463 | $13,284 | $19,651 | 493 |

| Cardiovascular Disease Minor Surgery | $8,510 | $6,782 | $9,423 | 396 |

| Ophthalmology No Surgery | $4,433 | $3,433 | $5,384 | 347 |

| Gastroenterology No Surgery | $7,068 | $5,991 | $8,326 | 310 |

| General Practice No Surgery | $6,236 | $4,844 | $7,494 | 308 |

| Pathology No Surgery | $6,197 | $5,329 | $7,494 | 306 |

| Neurology No Surgery | $8,452 | $6,782 | $10,270 | 288 |

| Pulmonary Disease No Surgery | $8,095 | $5,991 | $10,325 | 259 |

| Urology Minor Surgery | $9,534 | $7,509 | $10,769 | 234 |

| Nephrology No Surgery | $5,756 | $4,118 | $7,494 | 224 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

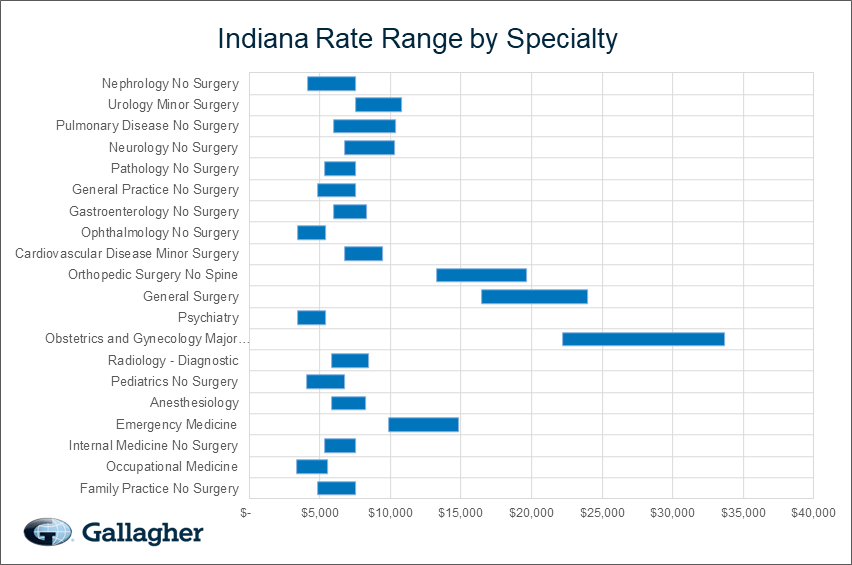

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in Indiana.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how Indiana compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.