Kansas Medical Malpractice Insurance

In Kansas, multiple carriers populate the medical malpractice insurance market, providing competitive options for the state's medical professionals. The stable market and numerous insurers make Kansas a physician-friendly state for medical malpractice insurance.

As a physician in Kansas, you may face medical malpractice claims and lawsuits at some point in your career. You likely have questions about the requirements for this essential coverage if you are new to the state. At Arthur J. Gallagher & Co., we have the industry insight to help answer your questions. You can better protect your reputation and assets when you know about physician malpractice insurance in Kansas.

Kansas Medical Malpractice Insurance Fast Facts

If you are a physician who is new to Kansas, you may have questions about medical malpractice requirements in the state. Do you need to carry medical malpractice insurance? If you are required to carry this insurance, how much coverage do you need? How much is medical malpractice insurance in Kansas?

Keep in mind that for specific answers to these questions, you will need to discuss your situation with an insurance expert who can tailor their responses to your circumstances.

1. Are You Required to Carry Malpractice Insurance in Kansas?

By law, all health care providers in the state of Kansas must hold medical malpractice liability insurance. The Kansas Department of Insurance will only allow physicians to purchase insurance from a state-admitted carrier. Admitted carriers are backed by the state guarantee and are regulated by the Department of Insurance.

The state legislature created the Health Care Provider Insurance Availability Plan to provide insurance for those physicians who cannot obtain commercial state admitted insurance coverage because of nontraditional practice or claims.

Health care providers are also required to participate in the Health Care Stabilization Fund (HCSF), which provides additional coverage on top of their commercial carrier policy. Health care providers are to select one of three options for additional coverage provided by the HCSF and are then charged a surplus on their premium. Those options include a per claim limit with an aggregate limit of:

- $100,000 per claim with $300,000 annual aggregate

- $300,000 per claim with $900,000 annual aggregate

- $800,000 per claim with $2.4M annual aggregate

With one exception, there are no additional charges from the Fund for physicians practicing in other states outside of Kansas. However, physicians practicing in both Missouri and Kansas are assigned a 25% surcharge.

2. How Much Malpractice Insurance Do I Need in Kansas?

In Kansas, your malpractice insurance policy needs to provide per claim limits of $200,000, along with an aggregate limit of $600,000. Insurance requirements also depend on your location and specialty, so if you have a higher-risk specialty, you may want to obtain more than the minimum required coverage.

3. How Much Are Kansas Medical Malpractice Insurance Rates?

The cost of medical malpractice insurance in Kansas varies based on your prior history of malpractice claims, county, specialty and policy type. If you have a high-risk specialty and want to carry more than the state's minimum required coverage, you may pay a higher rate for insurance.

Whether you select a claims-made policy or an occurrence policy will also impact your rate. Typically, a claims-made policy is less expensive than an occurrence policy, as it provides less robust coverage. A claims-made policy covers only claims that are made while your policy is active, while an occurrence policy covers malpractice incidents that take place during your coverage's active period, no matter when they make the claim.

With an occurrence policy, you will have coverage for an incident that occurred while you had insurance, even if you no longer have an active policy. With a claims-made policy, however, if you no longer have active coverage, the claim will not be covered.

Statute of Limitations

The statute of limitations in Kansas is two years after the injury should reasonably be identified by the injured person. In no event can a patient bring a medical malpractice action more than four years after the malpractice incident. For wrongful death, the statute of limitations is also two years.

Top Carriers in Kansas

In Kansas, the top medical malpractice insurance carriers can change often due to merging companies and new companies entering the market. We have connections at Arthur J. Gallagher & Co. to top carriers in the state and across the nation, which means we can connect you to carriers that can offer the best available coverage options and terms.

Insurance Companies in Kansas

You may struggle to find the insurance company that can meet your coverage needs if you try to navigate the market alone. When you have Gallagher as your insurance advisor and partner, you can find the best rates and easily navigate the various Kansas insurance companies.

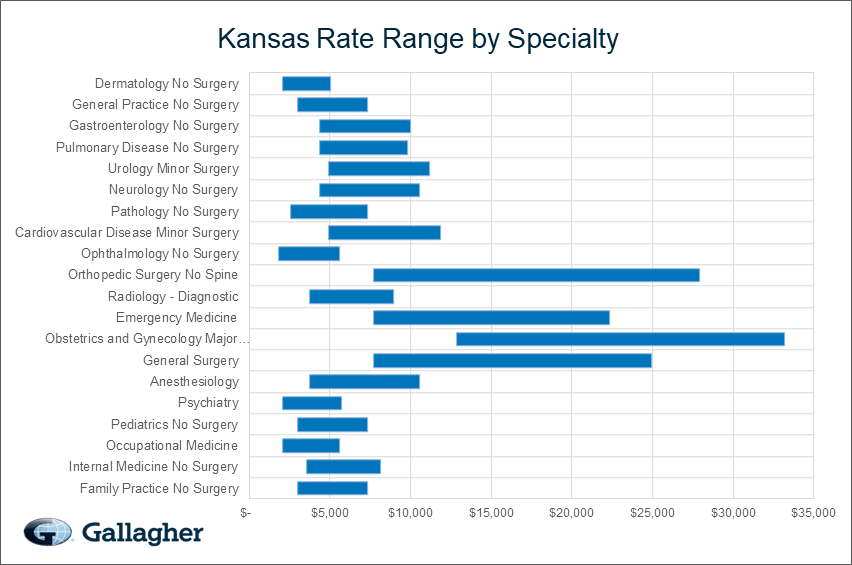

Kansas Medical Malpractice Insurance Rates by Specialty

Malpractice insurance rates in Kansas vary depending on your specialty. Physicians with a high-risk specialty, such as surgeons, tend to pay higher rates than physicians with a lower-risk specialty. Malpractice insurance costs in Kansas also depend on your claim history and location. Speak with an insurance expert at Gallagher who can offer you a specific quote for medical malpractice insurance.

Why Partner With Gallagher in Kansas

If you decide to partner with us at Arthur J. Gallagher & Co., you will gain access to the state's largest physician malpractice liability insurance provider. We are able to secure the best possible terms for the medical professionals we work with because of our connections to major insurers across the nation.

When you work with us, you will speak with a real insurance expert about your medical malpractice needs. You also won't have to pay us for finding the right insurance policy for you. We offer the physicians who work with us the following benefits:

- We handle all the work needed to find you the right insurer.

- We ensure you don't need separate tail coverage.

- We examine your needs to provide custom coverage solutions.

- We offer multiple quotes so you can determine the right fit for you.

- We identify discounts you may qualify for, such as a new-to-practice discount or a claims-free discount.

Without the assistance of an experienced insurance advisor, you will have to negotiate coverage terms on your own. When you work with us at Gallagher, you'll be able to obtain the most favorable terms with our insurance knowledge and connections to the top insurers.

Resource for Physicians in Kansas

In Kansas, physicians are required to carry malpractice insurance. This coverage is essential for protecting your personal assets and your professional reputation in the event of a malpractice claim against you. At Arthur J. Gallagher & Co., we have assisted numerous medical professionals and facilities with finding coverage at the best possible terms.

If you are a physician looking for medical malpractice insurance in Kansas, you can request a quote or contact us today to learn more about Kansas medical malpractice insurance limits and requirements.

Kansas Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 200,000/600,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Family Practice No Surgery | $5,532 | $2,960 | $7,350 | 1,686 |

| Internal Medicine No Surgery | $5,888 | $3,539 | $8,108 | 896 |

| Occupational Medicine | $3,995 | $2,059 | $5,580 | 701 |

| Pediatrics No Surgery | $4,905 | $2,960 | $7,350 | 404 |

| Psychiatry | $4,312 | $2,059 | $5,735 | 354 |

| Anesthesiology | $7,089 | $3,733 | $10,580 | 336 |

| General Surgery | $19,423 | $7,722 | $24,964 | 313 |

| Obstetrics and Gynecology Major Surgery | $25,702 | $12,869 | $33,186 | 311 |

| Emergency Medicine | $13,635 | $7,722 | $22,320 | 281 |

| Radiology - Diagnostic | $7,176 | $3,733 | $8,965 | 254 |

| Orthopedic Surgery No Spine | $18,221 | $7,722 | $27,900 | 235 |

| Ophthalmology No Surgery | $4,078 | $1,802 | $5,580 | 140 |

| Cardiovascular Disease Minor Surgery | $8,382 | $4,890 | $11,832 | 134 |

| Pathology No Surgery | $4,998 | $2,574 | $7,350 | 132 |

| Neurology No Surgery | $7,345 | $4,376 | $10,580 | 122 |

| Urology Minor Surgery | $8,755 | $4,890 | $11,160 | 105 |

| Pulmonary Disease No Surgery | $7,023 | $4,376 | $9,807 | 77 |

| Gastroenterology No Surgery | $7,142 | $4,376 | $9,972 | 77 |

| General Practice No Surgery | $5,532 | $2,960 | $7,350 | 65 |

| Dermatology No Surgery | $4,167 | $2,059 | $5,012 | 64 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in Kansas.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how Kansas compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.