Maryland Medical Malpractice Insurance

As a physician in Maryland, you may face many hurdles in getting the medical malpractice insurance coverage you need. While the malpractice insurance market in Maryland was once unstable, it has since become stabilized.

If you have questions about medical malpractice insurance in Maryland, Arthur J. Gallagher & Co. has the answers you need and can offer valuable guidance. Understanding this vital coverage can help you make the right choice and protect your career in the event of a malpractice suit.

Maryland Medical Malpractice Insurance Fast Facts

If you are new to practicing medicine in Maryland, you may have concerns and questions about Maryland medical malpractice insurance requirements. What is the cost of malpractice insurance in the state? Are you required to carry coverage to practice? We address the most frequently asked questions below:

1. Are You Required to Carry Malpractice Insurance in Maryland?

Maryland is one of many states that does not require medical professionals to carry malpractice insurance. Even though this state does not have a carrying requirement for malpractice coverage, you may still be required to obtain coverage in certain situations, such as:

- You want to work at a specific hospital: Many health care facilities mandate that doctors with visiting privileges obtain medical malpractice insurance.

- You want to participate in a certain health insurance plan: Some health insurance plans also may require physicians to obtain malpractice coverage.

Going bare offers no protection in the event of a malpractice lawsuit, which is why many medical professionals elect to carry coverage in states that do not require them to do so. Malpractice coverage can offer protection for your professional reputation and personal assets in the event that a patient sues you for malpractice.

2. How Much Malpractice Insurance Do I Need in Maryland?

Maryland medical malpractice insurance requirements are related to where you are located and what your specialty is. If you are a surgeon, for example, you may need more coverage than a doctor who does not perform operations, as the risk is greater for your patients.

Different types of policies can also impact how much coverage you need. When selecting a malpractice insurance policy, you will decide between an occurrence policy or a claims-made policy, along with whether to add on tail or nose coverage:

- Claims-made policy: A claims-made policy covers only claims that are made while your policy is active, no matter when the incident takes place. If a patient brings a lawsuit against you after your policy has expired, you may not be covered for the lawsuit.

- Occurrence policy: An occurrence policy covers any incidents that occur during the active period of the coverage. Thus, if a patient brings a malpractice claim against you after your insurance policy expires and the incident occurred while the policy was active, your malpractice insurance will cover the cost.

- Tail coverage: To avoid a lack of coverage when you need it, you may want to consider extending your protection with tail coverage. This will give you coverage for years after a policy's official expiration.

- Nose coverage: You may want to purchase nose coverage on your new policy, which will give you retroactive coverage back to a certain date.

3. What Is the Cost of Malpractice Insurance in Maryland?

Similar to how much coverage you will need, your insurance rate will depend on the county you live in and your specialty, along with your previous history with malpractice claims. If you are a physician with a high-risk specialty, you may want to carry an amount of coverage greater than a physician with a low-risk specialty. The more coverage you carry, the higher your insurance rate will be. An insurance expert at Arthur J. Gallagher can provide you with more specific information about your possible cost for malpractice insurance.

Tort Reform in Maryland

In 2004, the Maryland House of Representatives introduced the Maryland Patients' Access to Quality Health Care Act. It was a struggle to eventually get this bill passed. Maryland experienced a big scare with the threat of some large physician and surgical groups leaving their Maryland practices altogether, with the struggle peaking when the bill was vetoed by the then Governor of Maryland.

Eventually, however, in the first quarter of 2005, HB2 was passed and became law. One of the most important aspects of this bill was the cap it placed on "non-economic" damages. For incidents occurring between January 1, 2005, and December 31, 2008, the non-economic damages were limited to $650,000. Beginning in 2009, this cap automatically increased by $15,000 each year.

In addition to the non-economic damage cap, the following provisions are included in House Bill 2, also known as Maryland Tort Reform:

- Letter of Merit required to prove medical malpractice

- Joint and several liability

Statute of Limitations

The statute of limitations in Maryland for medical malpractice is five years from the date of the incident or three years from the date of discovery.

Top Carriers in Maryland

The top carriers in Maryland can change often, as malpractice carriers merge and new carriers enter the market in the state. Both experienced and new doctors may struggle to keep up with the regular market changes. Our clients at Gallagher Healthcare work with us because of our relationships with top carriers throughout the country.

Maryland Medical Malpractice Insurance Companies

With several malpractice insurance companies serving the state of Maryland, you may struggle to locate the best coverage on your own. Most doctors are unable to get the best malpractice insurance rates alone. When you have a malpractice insurance advisor such as Gallagher as your partner, you can successfully navigate the numerous Maryland insurance companies.

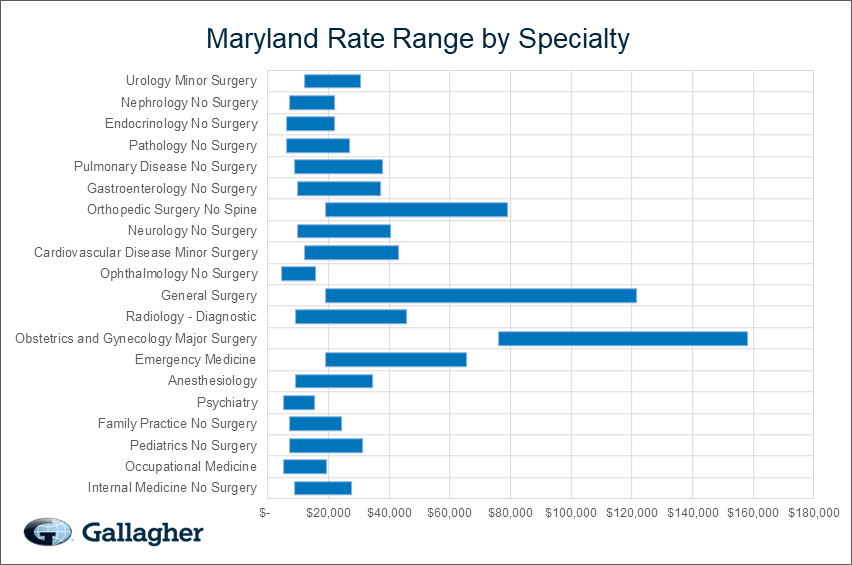

Maryland Medical Malpractice Insurance Rates by Specialty

Medical malpractice insurance rates vary by specialty in Maryland. Physicians with higher-risk specialties tend to pay more than physicians with lower-risk specialties. You can consult with the insurance experts at Gallagher for a specific quote.

Why Partner With Gallagher in Maryland

When you choose Gallagher Healthcare as your advisor, you will have access to the largest medical malpractice insurance provider in Maryland. Because of our various connections to top carriers in the state, we can find the best possible terms for you. Enjoy the following benefits when you partner with us:

- Savings

- Discounts

- Accurate insurance quotes

- Custom insurance solution

- Exceptional customer service

- Best possible coverage terms

Resource for Physicians in Maryland

Though you are not required to carry medical malpractice insurance in Maryland, you may not be allowed to work in certain facilities without coverage. At Gallagher, we are a reputable and trusted advisor, and we can help you locate the policy you need for an affordable price.

We strive to find our clients the policies that address all their insurance needs. Request a quote or contact us at Gallagher for the policy that meets your insurance needs.

Maryland Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 1,000,000/3,000,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Internal Medicine No Surgery | $16,134 | $8,642 | $27,471 | 3,180 |

| Occupational Medicine | $10,475 | $5,027 | $19,425 | 1,674 |

| Pediatrics No Surgery | $15,705 | $7,227 | $31,135 | 1,407 |

| Family Practice No Surgery | $15,011 | $7,227 | $24,420 | 1,289 |

| Psychiatry | $10,503 | $5,027 | $15,221 | 1,229 |

| Anesthesiology | $19,548 | $9,114 | $34,654 | 1,010 |

| Emergency Medicine | $39,213 | $18,854 | $65,402 | 911 |

| Obstetrics and Gynecology Major Surgery | $113,746 | $76,107 | $158,317 | 826 |

| Radiology - Diagnostic | $22,130 | $9,114 | $45,859 | 707 |

| General Surgery | $60,974 | $18,854 | $121,462 | 597 |

| Ophthalmology No Surgery | $10,568 | $4,400 | $15,704 | 561 |

| Cardiovascular Disease Minor Surgery | $24,802 | $11,941 | $42,902 | 535 |

| Neurology No Surgery | $21,222 | $9,720 | $40,488 | 390 |

| Orthopedic Surgery No Spine | $51,274 | $18,854 | $78,912 | 386 |

| Gastroenterology No Surgery | $19,106 | $9,720 | $36,983 | 363 |

| Pulmonary Disease No Surgery | $19,805 | $8,737 | $37,743 | 302 |

| Pathology No Surgery | $14,356 | $6,285 | $26,861 | 277 |

| Endocrinology No Surgery | $13,915 | $6,285 | $21,825 | 264 |

| Nephrology No Surgery | $15,217 | $7,227 | $21,825 | 235 |

| Urology Minor Surgery | $22,733 | $11,941 | $30,443 | 223 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in Maryland.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how Maryland compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.