North Carolina Medical Malpractice Insurance

The North Carolina medical malpractice insurance marketplace has familiarities to that of other states across the United States. Competition in the state amongst carriers has increased dramatically over the past 5 to 10 years, which has furthered rate reductions across the board.

Like other states across the country, malpractice rates soared in the years from 1995 to 2003, with certain specialties seeing massive increases in medical malpractice rates. Since 2003, rates have stabilized and even fell below where they were before the hard market. Claims frequency, like other states, has steadily decreased, while the average claim payment has decreased.

North Carolina Medical Malpractice Insurance Fast Facts

Are you a new physician in North Carolina? If so, you may have questions about medical malpractice in the state. How much does medical malpractice insurance cost in North Carolina? Do North Carolina physicians need to carry malpractice coverage? Though specifics to any of your questions about malpractice insurance will vary depending on your area and specialty, you can find answers to some of the most commonly asked questions about medical malpractice insurance in North Carolina below.

1. Are You Required to Carry Malpractice Insurance in North Carolina?

If you are a medical professional in North Carolina, you are not required to obtain malpractice insurance. However, you may still want to, since carrying malpractice insurance in North Carolina will protect your finances and reputation if you face a malpractice claim.

Additionally, hospitals and other healthcare facilities may mandate that physicians carry medical malpractice insurance while working in their facility. Even in states with generous liability limits and tort reform, carrying medical malpractice coverage can save you from a significant financial loss due to a lawsuit.

2. How Much Malpractice Insurance Do I Need in North Carolina?

In North Carolina, how much medical malpractice insurance you will need depends on your location and specialty. Medical professionals with higher-risk specialties, such as surgeons and obstetricians, tend to need more coverage than physicians who do not work in higher-risk specialties. This difference in coverage amount is due to the greater risk posed to the patient.

You may also want to consider whether some facilities require a minimum amount of coverage. If you want to work in a North Carolina healthcare facility, you may need to find out if the facility requires a minimum level of malpractice coverage for physicians.

Additionally, the amount of medical malpractice insurance you need in North Carolina depends on the type of policy you choose — an occurrence or claims-made policy:

- Occurrence policy: This policy will cover any incident that occurs while your coverage is active. If a patient pursues a lawsuit against you after your policy has expired, but the incident occurred while you had coverage, your policy will cover the costs of the lawsuit.

- Claims-made policy: This policy will cover claims that are made only while you are carrying the policy. If your claims-made policy has expired and a patient files a lawsuit against you, you will not have coverage for the costs of the lawsuit. To avoid this situation, you can purchase nose or tail coverage to extend the length of protection you get from your policy.

While a claims-made policy tends to have a lower premium, especially during the first years of a medical professional's practice, this cost does increase over time. Claims-made policies increase in price an average of 75% from the first year. However, even with an increase over time, the overall cost for a claims-made policy tends to be less than an occurrence policy.

Although claims-made policies could cost you less initially, they may cost you more due to the need to pay more for lawsuits if you find yourself without coverage. You may also need to determine whether you need nose or tail coverage. Nose coverage can provide coverage retroactively and fill in gaps from your claims-made policies.

If you are unsure how much medical malpractice insurance you need in North Carolina, you can discuss your insurance situation with a medical malpractice insurance expert at Arthur J. Gallagher & Co.

3. How Much Are North Carolina Malpractice Insurance Rates?

What is the cost of medical malpractice insurance in North Carolina? Your cost for malpractice insurance will depend on your county and specialty, along with your prior history of malpractice claims.

If you are a medical professional who practices a high-risk specialty and needs to carry a larger amount of coverage, you will also have a higher insurance rate. Alternatively, if you are a doctor with a lower-risk specialty, you will not have to pay as high of a cost for your medical malpractice insurance. An insurance professional can give you a more accurate and specific answer about the costs for the specific amount of malpractice coverage you need.

Tort Reform in North Carolina

In 2007, the state enacted the Voluntary Arbitration of Negligent Health Care Claims Act, which placed an award of damages cap on non-economic injuries at $1,000,000 if both parties agree to enter into a binding arbitration agreement. Although North Carolina enacted tort reform, the state continues to be one of the highest in claims frequency, ranking 4th of 51. In 2011, the governor of North Carolina vetoed a bill for tort reform that would have placed a non-economic damage cap at $500,000.

Liability Limits

What are the liability limits for medical professionals in North Carolina? The liability limit on damages for non-economic losses due to medical malpractice was previously $500,000. This limit was updated in 2017 to $533,409.

Top Carriers in North Carolina

The top carriers in North Carolina can change every few years due to new insurance companies entering the market and mergers between existing insurance companies. Keeping track of the top carriers in the state when they are changing frequently can be a challenging task to handle on your own.

At Gallagher, we will use our connections to major carriers across the nation to obtain the best coverage options and most favorable terms for you.

Insurance Companies in North Carolina

Since there are so many insurance companies serving North Carolina, you may struggle to find the right provider for you with the most favorable coverage terms. Many policy buyers are not able to get the best insurance rate on their own. When you have an advisor like Gallagher on your side, you can more easily navigate the myriad of North Carolina medical malpractice insurance carriers.

Below are a few common malpractice insurance carriers in North Carolina.

- The Medical Protective Company

- ISMIE Indemnity Company

- ProSelect Insurance Company

- Medical Mutual Insurance Company of North Carolina

- The Doctors Company

- Admiral Insurance Company

- Applied Medico-Legal Solutions (AMS RRG)

- Darwin National Assurance Company

- Evanston Insurance Company

- Hallmark Specialty Insurance Company

- Hudson Excess Insurance Company

- MedChoice Risk Retention Group, Inc.

- National Fire & Marine Insurance Company

- NORCAL Mutual Insurance Company

- Underwriters at Lloyd's, London

- MAG Mutual Insurance Company

- Professional Security Insurance Company

- American Casualty Company of Reading, PA

- ProAssurance Specialty Ins Co, Inc.

- Ironshore Specialty Insurance Co

North Carolina Medical Malpractice Insurance Rates By Specialty

North Carolina medical malpractice insurance rates are impacted by your specialty. A doctor who provides higher risk care to his or her patients will have a higher rate of cost for insurance than a doctor who provides lower risk care. You can consult a medical malpractice insurance expert at Gallagher for medical malpractice quotes that are specific and accurate to your circumstances and specific insurance needs.

Why Partner With Gallagher in North Carolina

When you partner with us at Gallagher, you will gain access to North Carolina's largest provider of medical malpractice insurance. We have connections to all the major insurance providers, which means we can broker the most favorable coverage terms for you.

You will not need to deal with a computer when you partner with us. Instead, you will communicate with a real insurance expert. We also will not charge you for finding the right insurance provider and policy for you, as we get our commissions from the insurance companies we work with.

Without our assistance, policy buyers must negotiate malpractice coverage terms on their own, which is difficult to do well without the knowledge and connections we have. Partnering with us ensures that you will receive the best rates for all of your coverage needs.

Resource for Physicians in North Carolina

While North Carolina law does not require medical professionals to obtain medical malpractice insurance coverage, you may not be able to practice in some facilities if you do not carry coverage. At Gallagher, we have assisted numerous medical professionals in finding the insurance they need and obtaining the best possible coverage terms. We can help you find the coverage that will ensure your practice's long-term viability and provide you with peace of mind in the event that you are sued by a patient for medical malpractice.

If you want more information about medical malpractice insurance in North Carolina or an accurate quote for coverage, contact us at Gallagher today.

North Carolina Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 1,000,000/3,000,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Family Practice No Surgery | $9,059 | $6,077 | $12,133 | 3,512 |

| Internal Medicine No Surgery | $9,852 | $7,267 | $12,309 | 3,136 |

| Occupational Medicine | $6,023 | $3,357 | $7,722 | 2,350 |

| Pediatrics No Surgery | $9,089 | $6,077 | $12,133 | 1,716 |

| Emergency Medicine | $22,437 | $15,855 | $29,419 | 1,439 |

| Psychiatry | $6,891 | $4,227 | $9,706 | 1,209 |

| Obstetrics and Gynecology Major Surgery | $53,110 | $41,672 | $80,274 | 1,114 |

| Radiology - Diagnostic | $12,163 | $7,664 | $16,170 | 1,006 |

| Anesthesiology | $11,523 | $7,664 | $14,666 | 998 |

| General Surgery | $31,186 | $15,855 | $45,517 | 813 |

| Orthopedic Surgery No Spine | $27,679 | $15,855 | $37,295 | 740 |

| Cardiovascular Disease Minor Surgery | $14,266 | $7,622 | $23,868 | 655 |

| Ophthalmology No Surgery | $6,055 | $3,593 | $9,706 | 525 |

| Gastroenterology No Surgery | $11,358 | $8,985 | $16,170 | 474 |

| Neurology No Surgery | $13,129 | $8,985 | $17,136 | 409 |

| Urology Minor Surgery | $13,767 | $10,041 | $19,413 | 368 |

| Pathology No Surgery | $8,637 | $5,285 | $9,995 | 339 |

| Dermatology No Surgery | $6,341 | $4,227 | $8,493 | 321 |

| Pulmonary Disease No Surgery | $12,044 | $7,647 | $18,825 | 318 |

| Nephrology No Surgery | $9,044 | $6,077 | $11,343 | 282 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

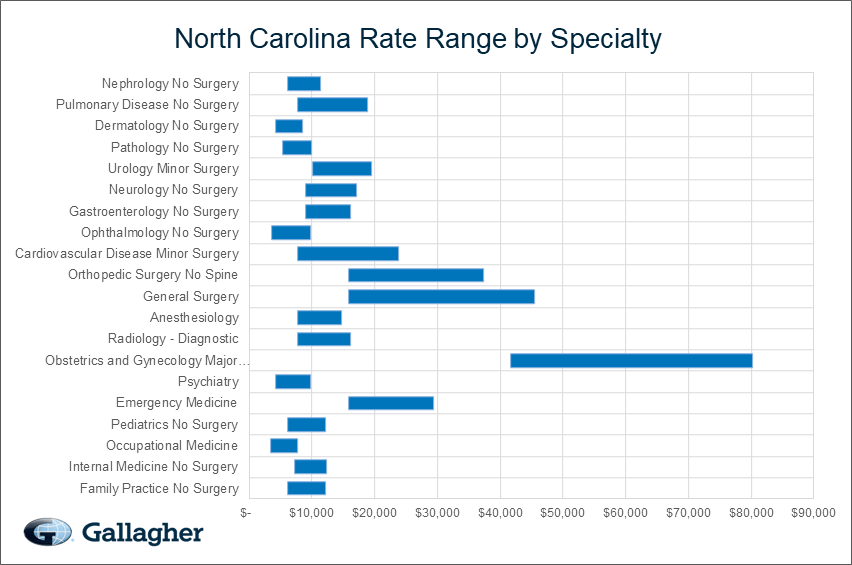

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in North Carolina.

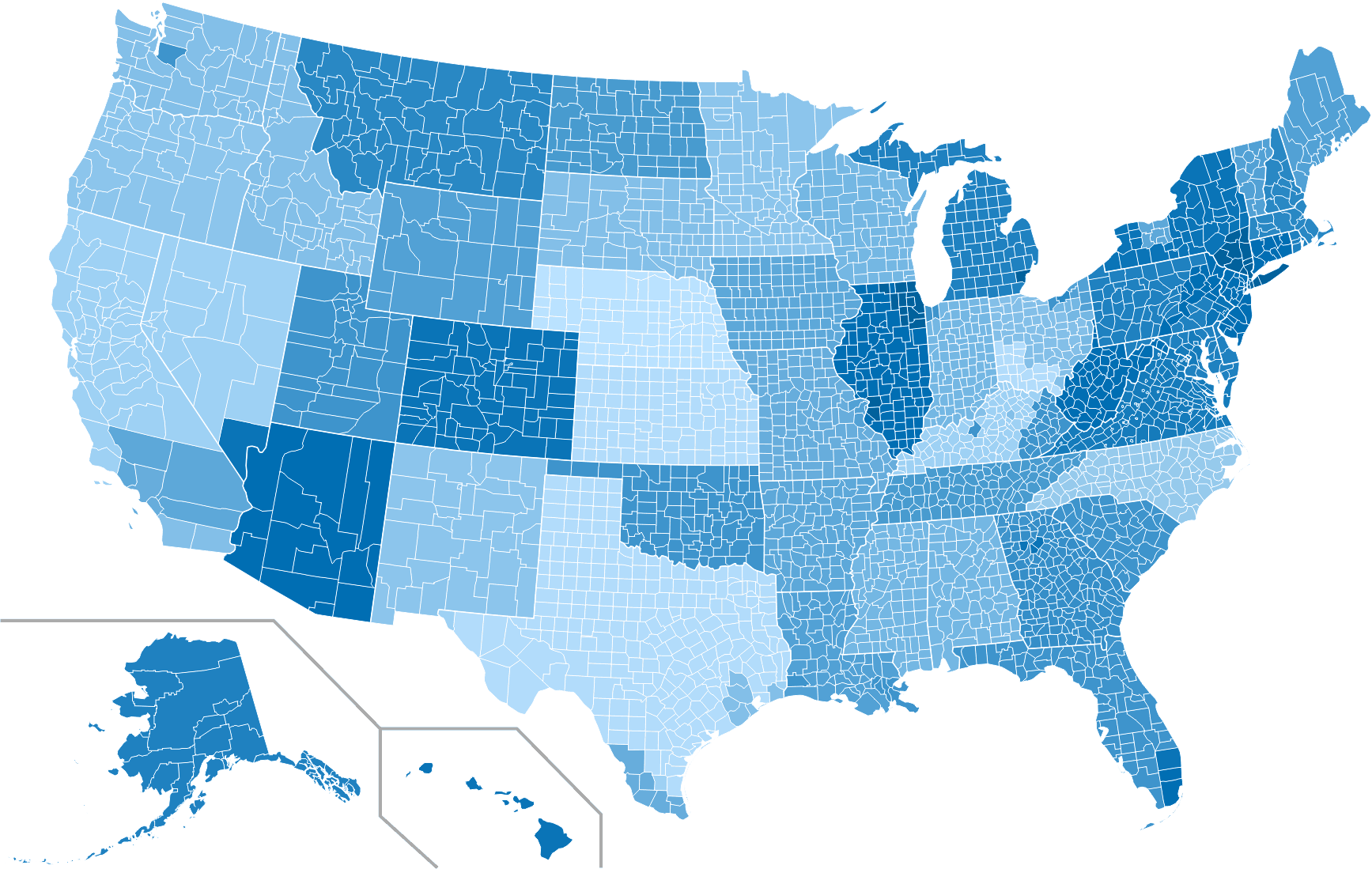

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how North Carolina compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.