Oregon Medical Malpractice Insurance

Medical malpractice insurance rates in Oregon have been slowly but steadily decreasing for years despite a small increase in claim severity. The absence of tort reform in the state allows for costly claims. However, in today's soft market and given the state's favorable loss ratio overall, medical malpractice insurance premiums in Oregon remain competitive.

Oregon Medical Malpractice Insurance Fast Facts

Medical professionals who are new to the state tend to have many questions about medical malpractice insurance in Oregon and how this coverage works. Are you required to carry this coverage to practice medicine in the state? How much does malpractice insurance cost in Oregon? How much coverage should you obtain? Below, we cover these frequently asked questions:

1. Are You Required to Carry Malpractice Insurance in Oregon?

Oregon is one of many states that does not require physicians to carry medical malpractice insurance. Though Oregon does not have any minimum carrying requirements, you may still face requirements to obtain medical malpractice coverage in certain situations.

Many health care facilities mandate that doctors with visiting privileges carry malpractice insurance, and some health insurance plans require that you have medical malpractice insurance to participate in their coverage. Buying this insurance can ensure your professional reputation and assets are protected if you face a malpractice claim.

2. How Much Malpractice Insurance Do I Need in Oregon?

The amount of malpractice insurance you should obtain depends on your location and specialty. Surgeons tend to require more coverage than physicians who do not perform operations, as surgery presents a greater risk to patients.

If you do not perform surgeries, you may want to consider the minimum coverage requirements of most health care facilities in Oregon. If you want visiting privileges at a facility, you may need to carry their minimum amount of coverage. This can inform how much you choose to purchase. If you purchase $200,000/$600,000 coverage, for example, the first amount is how much your insurance company will pay per claim and the second value is your annual limit.

3. How Much Is Malpractice Insurance in Oregon?

The cost of medical malpractice insurance in Oregon varies depending on your county and specialty, along with your history of malpractice claims. The more coverage you obtain, the higher your rate will be.

The policy type you choose may also impact your insurance rate. An occurrence policy tends to be more expensive than a claims-made policy. If you choose to add on nose or tail coverage, this can increase your rate as well:

- Occurrence policies: These policies cover incidents that occur during your coverage's active period. This means if a patient brings a lawsuit against you after your policy has expired, but the incident occurred while you had coverage, the cost will be covered by your insurance.

- Claims-made policies: These policies cover only claims that are made while you are carrying the policy, no matter when the incident took place. This means if a patient brings a lawsuit against you after your policy has expired, the cost won't be covered by your insurance.

- Nose coverage: This provides you retroactive coverage back to a certain date, such as when your expired policy ended so you have no gaps in coverage.

- Tail coverage: Tail coverage can fill in years-long gaps in coverage between your policies. This coverage can be particularly helpful for retiring physicians or physicians leaving the medical field.

Discuss your coverage options with an insurance expert who can help you determine what the best policy or gap coverage may be for your situation.

Statute of Limitations

In Oregon, the statute of limitations for medical malpractice claims is two years from discovery or from the time reasonable care should have led to the discovery. For wrongful death, the statute of limitations is three years.

Liability Limits

Liability limits vary from state to state. Below are some of the liability limits in Oregon:

- Modified comparative negligence: If a claimant's fault is determined to be greater than that of all defendants and settled parties combined, the claimant's action is barred. Additionally, a plaintiff's recovery is reduced by the percentage of their fault.

- Vicarious liability: Oregon allows a facility to be held liable for the negligence of an independent contractor under the theory of apparent agency.

- Limited joint and several liability: A defendant is considered liable in proportion to the percentage of fault for awarded damages.

- Damage cap: There is no damage cap in Oregon. However, punitive damages cannot be awarded against individual health care practitioners, excluding facilities, as defined by law.

Malpractice cases tend to have lower liability limits than wrongful death suits.

Top Carriers in Oregon for Medical Malpractice Insurance

The medical malpractice insurance carriers tend to change every few years in most states. This changing market is due to insurance companies merging and others entering the market. At Arthur J. Gallagher & Co., we can connect you to the top carriers in Oregon to help you find the best possible coverage for your situation.

Below are a few common malpractice insurance carriers in Oregon.

- The Doctors Company

- Physicians Insurance

- Continental Casualty Company

- Medical Protective Company

- Admiral Insurance Company

- National Fire & Marine Insurance Co

- UMIA Insurance, Inc.

- American Casualty Company of Reading, PA

- NCMIC Insurance Company

- Health Care Industry Liab Recip Ins RRG

- ProSelect Insurance Company

- Columbia Casualty Company

- Coverys Specialty Insurance Company

- NORCAL Mutual Insurance Company

- American Excess Insurance Exch RRG

- Princeton Excess & Surplus Lines Ins Co

- TDC Specialty Insurance Company

- ProAssurance Indemnity Company, Inc.

- MAG Mutual Insurance Company

- Preferred Professional Insurance Company

- ProAssurance Specialty Ins Co, Inc.

- Kinsale Insurance Company

- Professional Solutions Ins Co

- NORCAL Specialty Insurance Company

- Lone Star Alliance, Inc., RRG

- Chubb Custom Insurance Company

- NCMIC Risk Retention Group, Inc.

- ISMIE Indemnity Company

- Professional Security Insurance Company

- Allied World Surplus Lines Insurance Co

- Beazley Insurance Company, Inc.

- American Alternative Insurance Corp

- Hudson Insurance Company

Medical Malpractice Insurance Companies in Oregon

Numerous medical malpractice companies serve Oregon, which means it may be difficult to pinpoint the insurer that can offer you the right coverage. Most physicians are not able to get the best insurance rates on their own. You can more easily navigate the many Oregon medical malpractice insurers when you have an advisor like Gallagher on your side.

Oregon Medical Malpractice Insurance Rates by Specialty

Medical malpractice insurance rates in Oregon vary by specialty. Physicians who offer high-risk care pay higher insurance rates than those who offer lower-risk medical care. Prices will also depend on your location and claim history. Speak with an insurance expert for a more specific malpractice insurance quote.

Why Partner With Gallagher in Oregon

By partnering with Gallagher, you'll gain access to Oregon's largest provider of medical malpractice liability insurance. We actively interact with each of the state's major insurance companies, which means we can find the best possible terms for you. Rather than deal with a computer, you'll speak with a real expert in Oregon medical malpractice insurance who can help you secure the coverage you need.

Resource for Physicians in Oregon

While you are not required by Oregon state law to obtain malpractice insurance, you may not be able to practice at certain medical facilities without it. To protect your assets and professional reputation, you may want to purchase adequate medical malpractice coverage.

At Gallagher, we have assisted numerous physicians in finding the coverage needed at the best possible terms. Learn more about our malpractice insurance or request a quote from us today.

Oregon Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 1,000,000/3,000,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Family Practice No Surgery | $7,684 | $5,667 | $8,824 | 1,862 |

| Internal Medicine No Surgery | $8,591 | $6,776 | $9,701 | 1,624 |

| Occupational Medicine | $5,120 | $3,942 | $6,440 | 942 |

| Emergency Medicine | $16,873 | $8,360 | $22,584 | 638 |

| Anesthesiology | $9,833 | $7,146 | $11,886 | 606 |

| Pediatrics No Surgery | $7,837 | $5,667 | $8,824 | 578 |

| Psychiatry | $5,822 | $3,942 | $7,059 | 538 |

| Obstetrics and Gynecology Major Surgery | $39,881 | $24,639 | $46,459 | 464 |

| Radiology - Diagnostic | $10,100 | $7,146 | $11,945 | 405 |

| General Surgery | $29,088 | $14,783 | $44,039 | 373 |

| Orthopedic Surgery No Spine | $22,464 | $14,783 | $28,690 | 294 |

| Ophthalmology No Surgery | $5,875 | $3,450 | $7,059 | 291 |

| Neurology No Surgery | $11,033 | $8,378 | $12,200 | 193 |

| Cardiovascular Disease Minor Surgery | $12,586 | $9,363 | $16,040 | 176 |

| Gastroenterology No Surgery | $10,088 | $8,360 | $12,935 | 166 |

| Pathology No Surgery | $7,170 | $4,928 | $8,360 | 142 |

| Urology Minor Surgery | $11,254 | $9,363 | $14,118 | 138 |

| Dermatology No Surgery | $5,406 | $3,942 | $6,835 | 130 |

| Otorhinolaryngology Major Surgery | $15,749 | $8,378 | $21,509 | 124 |

| Pulmonary Disease No Surgery | $11,142 | $8,378 | $13,520 | 122 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

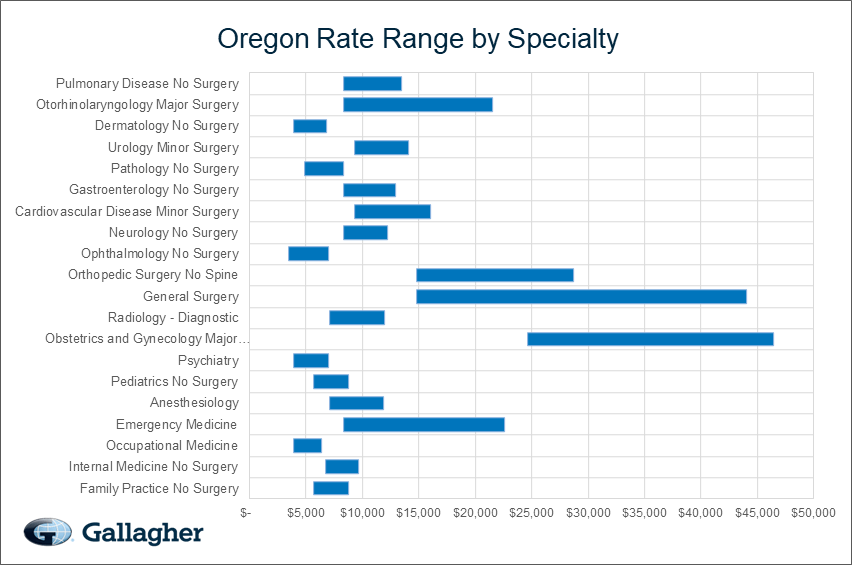

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in Oregon.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how Oregon compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.