Washington D.C. Medical Malpractice Insurance

The medical malpractice insurance market in Washington D.C. is one of the most unstable in the entire country. There has been no tort reform passed by the legislature to curb medical liability claims or payouts. Washington D.C. physicians and surgeons are facing rising medical malpractice insurance premiums on an almost annual basis with no relief in sight.

High-risk surgical providers, like OB-GYNs and neurosurgeons, are either leaving their Washington D.C. practices altogether or planning to stop providing high-risk procedures in the state to seek the more friendly legal environments located in Maryland or Virginia. Another factor contributing to the high premiums in Washington D.C. is the lack of competition among medical malpractice insurance companies. There are few standard-admitted physician insurers actively writing new policies in Washington D.C.

We are anticipating some downward pressure on rates as insurance companies compete in order to grab as much market share as possible over the next few years. At least with regard to the traditional, standard-admitted malpractice insurance companies and some alternative insurance carriers, Washington D.C. physicians and surgeons can expect the following policy features to be included in their coverage:

- Claims-made or occurrence policy forms

- Full physician consent-to-settle clause

- Defense costs outside of the liability limits

- AM Best Ratings of A- or better

- Free tail on claims-made policies for death, disability and retirement

- Complementary regulatory coverage including HIPAA/HITECH violation defense, administrative action defense, billing errors and omissions, and cyber liability

Washington D.C. Medical Malpractice Insurance Fast Facts

As a physician in Washington D.C., you may have questions about the state's medical malpractice insurance requirements. Are you required by law to carry this type of insurance? How much coverage should you carry? How much does medical malpractice insurance cost in Washington D.C.? Below, we cover the answers to these frequently asked questions.

1. Are You Required to Carry Malpractice Insurance in Washington D.C.?

Washington D.C. is not one of the seven states that requires physicians to carry medical malpractice insurance. It is also not one of the states that has minimum carrying requirements to be eligible for state liability reforms. However, despite this lack of a requirement in Washington D.C., you may be required to carry coverage in certain circumstances, such as if you want to work as a visiting physician at a health care facility that has minimum carrying requirements.

Even in states with liability limits and tort reform, medical malpractice insurance can save doctors from losing a significant amount of assets in the event of a lawsuit, along with a hit to your professional reputation.

2. How Much Malpractice Insurance Do I Need in Washington D.C.?

Washington D.C. insurance requirements are related to your location, specialty, policy type and health care facility. Since surgeons' care poses a greater risk to patients, these medical professionals may want to obtain more coverage.

The first amount of the policy is how much your insurance company will pay out for each claim, and the second amount is your annual policy limit. So if you purchase coverage of $100,000/$300,000, for example, your insurance company will pay out a maximum of $100,000 per claim and $300,000 annually.

3. How Much Are Washington D.C. Medical Malpractice Insurance Rates?

The cost of medical malpractice insurance in Washington D.C. is influenced by your county, history of malpractice claims and specialty. Medical professionals with high-risk specialties tend to carry more than the minimum level of coverage, which means they also usually pay more for insurance.

Your medical malpractice insurance rates in Washington D.C. depend on which policy you choose. If you select a claims-made policy, you may pay less than you would for an occurrence policy. However, you will also have less coverage with a claims-made policy, which may mean you have to get additional coverage with a nose or tail policy. Consult an insurance professional for more specific information about the level of coverage you may need.

Statute of Limitations

In Washington D.C., the statute of limitations for medical malpractice claims is three years. If a patient waits more than three years after the incident occurred, they would lose the right to sue. However, there are some exceptions, such as when the injury is discovered or should reasonably be discovered and when the injury occurs to a minor child.

Top Insurance Carriers in Washington D.C.

In many states, the top medical malpractice insurers tend to change often as companies merge or new companies enter the market. As such, it can be difficult for individuals to keep track of which carriers can offer the best physician malpractice insurance in Washington D.C. Fortunately, at Arthur J. Gallagher & Co., our connections to the top carriers across the nation can allow us to find the best available coverage for your insurance needs.

Washington D.C. Medical Malpractice Insurance Companies

Finding the best rate from the many medical malpractice insurance companies that serve Washington D.C. can be challenging on your own. With an insurance advisor like Gallagher Healthcare on your side, you can more easily navigate the many insurance companies in the state.

Washington D.C. Medical Malpractice Insurance Rates by Specialty

Washington D.C. malpractice insurance rates vary depending on your specialty. If you are a medical professional who offers high-risk care, you may pay a higher rate than a professional who offers lower-risk care. Additionally, rates vary depending on your location and claim history. For a more specific quote, discuss your circumstances with an insurance expert.

Why Partner With Gallagher in Washington D.C.

More than 60,000 medical professionals and more than 1,000 health care facilities partner with us at Gallagher Healthcare. We can secure excellent coverage terms for you, as we have frequent interactions with each state's major carriers. Without professional expertise on your side, it can be difficult to negotiate the terms of your coverage. Gallagher Healthcare is among the top Ethical Insurance Brokers in the country, and our range of products can ensure you get the coverage you need.

If you prefer not to deal with computers, you can speak with a real expert in Washington D.C. malpractice coverage when you partner with us. With our knowledge and connections in the industry, we can help you find the best possible rate.

Resource for Physicians in Washington D.C.

In the U.S., Gallagher Healthcare is the largest advisor for medical malpractice insurance. Though you may not be required to purchase coverage in Washington D.C., you may be unable to practice at your preferred health care facilities without it. We have assisted countless medical professionals and facilities in getting the coverage they need, and we can assist you as well.

If you would like more information about how much malpractice insurance costs or how it works in Washington D.C., you can learn more about this essential coverage or request a quote from us today.

Major Malpractice Insurance Companies

- ProAssurance Indemnity

- The Doctors Company

- Medical Protective

- NORCAL Mutual Insurance Company

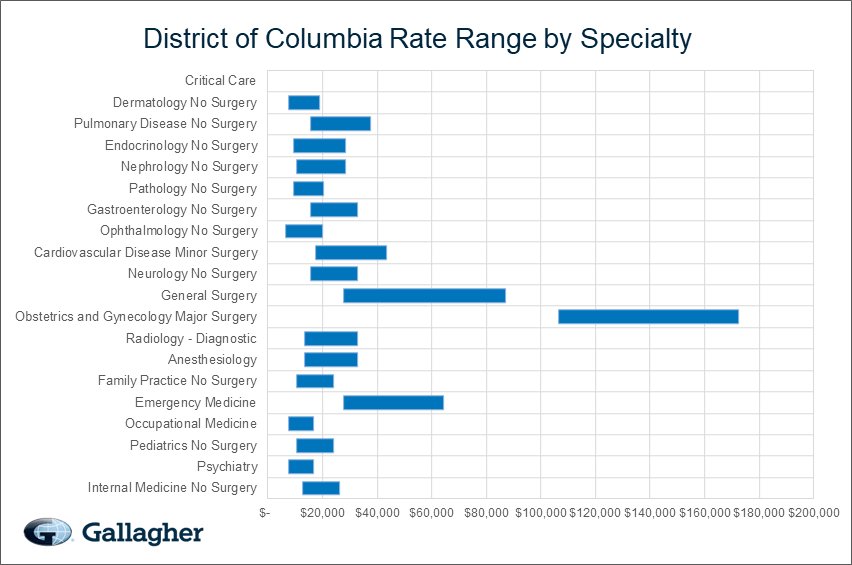

District of Columbia Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 1,000,000/3,000,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Internal Medicine No Surgery | $21,192 | $12,669 | $26,086 | 662 |

| Psychiatry | $12,762 | $7,369 | $16,552 | 391 |

| Pediatrics No Surgery | $19,336 | $10,594 | $24,010 | 326 |

| Occupational Medicine | $12,762 | $7,369 | $16,552 | 229 |

| Emergency Medicine | $49,538 | $27,638 | $64,495 | 218 |

| Family Practice No Surgery | $19,336 | $10,594 | $24,010 | 209 |

| Anesthesiology | $25,377 | $13,360 | $32,828 | 191 |

| Radiology - Diagnostic | $27,018 | $13,360 | $32,828 | 179 |

| Obstetrics and Gynecology Major Surgery | $131,982 | $106,444 | $172,548 | 161 |

| General Surgery | $70,903 | $27,638 | $87,236 | 137 |

| Neurology No Surgery | $24,696 | $15,663 | $32,828 | 122 |

| Cardiovascular Disease Minor Surgery | $32,951 | $17,504 | $43,591 | 120 |

| Ophthalmology No Surgery | $13,967 | $6,450 | $20,066 | 108 |

| Gastroenterology No Surgery | $24,696 | $15,663 | $32,828 | 95 |

| Pathology No Surgery | $17,293 | $9,213 | $20,275 | 78 |

| Nephrology No Surgery | $20,707 | $10,594 | $28,293 | 72 |

| Endocrinology No Surgery | $16,439 | $9,213 | $28,293 | 69 |

| Pulmonary Disease No Surgery | $28,795 | $15,663 | $37,666 | 66 |

| Dermatology No Surgery | $13,598 | $7,369 | $19,063 | 63 |

| Critical Care | $28,385 | $28,385 | $28,385 | 61 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in District of Columbia.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how District of Columbia compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.