Wisconsin Medical Malpractice Insurance

Medical professionals in Wisconsin may want to obtain medical malpractice insurance to protect their finances, reputation and healthcare facilities. Navigating the various medical malpractice coverage options available can be overwhelming for physicians, which is why our clients turn to us for guidance at Arthur J. Gallagher & Co.

Wisconsin Medical Malpractice Insurance Fast Facts

If you are new to practicing medicine in Wisconsin, you likely have questions about the requirements surrounding malpractice insurance in the state. Do you need to carry malpractice coverage to practice medicine in Wisconsin? How much is medical malpractice insurance in Wisconsin? Below, we provide answers for a few of the questions physicians in Wisconsin ask most frequently.

1. Are You Required to Carry Malpractice Insurance in Wisconsin?

Wisconsin is among the seven states that require physicians to obtain a minimum level of medical malpractice insurance. Even in states where medical malpractice insurance coverage is not a requirement for physicians, many medical professionals still decide to obtain coverage. Many healthcare facilities also require that physicians maintain medical malpractice coverage to practice medicine in their facilities.

Beyond fulfilling the state requirement, malpractice insurance can provide coverage in the event of a malpractice lawsuit against you. Practicing medicine without malpractice insurance could put your assets and professional reputation at risk.

2. How Much Malpractice Insurance Do I Need in Wisconsin?

The amount of coverage you need will vary based on your specialty and preference. Because Wisconsin requires malpractice insurance, you will at least need to fulfill the state minimum. According to current Wisconsin law, every physician and CRNA must purchase medical malpractice insurance with a limit of $1M per occurrence and a $3M annual aggregate.

3. How Much Does Medical Malpractice Insurance Cost in Wisconsin?

Rates for medical malpractice insurance in Wisconsin depend on your county, specialty and previous history of malpractice claims. If you are a medical professional with a high-risk specialty, you may want to carry a larger amount of malpractice coverage than a physician with a lower-risk specialty. When you carry more coverage, your insurance rate will be higher.

Additionally, your malpractice insurance cost in Wisconsin will be affected by the coverage options you choose and the type of policy you select. You can choose between occurrence and claims-made policies and nose or tail coverage.

Tort Reform in Wisconsin

The Wisconsin medical malpractice insurance marketplace is different than that of most states around the country. The main difference is that Wisconsin has what is referred to as a Patient Compensation Fund. It is required by Wisconsin law that applicable physicians and CRNAs participate in the Wisconsin Patient Compensation Fund. This program was developed in order to provide compensation to patients in cases where the physician's primary malpractice insurance limit is exhausted.

Wisconsin, like many other states, has experienced rate decreases over the last several years with more malpractice insurance carriers entering the state and with the overall softening of the commercial insurance marketplace.

Claims Trends and Analysis in Wisconsin

According to recent claims trends in Wisconsin, the state has seen the number of paid medical malpractice insurance claims drop significantly since 1991.

Statute of Limitations

The statute of limitations in Wisconsin is three years from the date the injury occurred or one year from when the injury was discovered or should have been discovered. An action cannot be commenced more than five years from the date of the malpractice incident.

Liability Limits

Wisconsin currently has damage caps in place for certain circumstances. Wisconsin's non-economic damage cap is currently at $750,000. Wisconsin law has a provision where if malpractice causes death to a minor, the maximum non-economic damage cap is at $500,000.

Top Carriers in Wisconsin

The top medical malpractice insurance carriers in Wisconsin change regularly as new companies enter the Wisconsin market and existing companies merge. Individual physicians, especially new physicians, may face difficultly in keeping up with the changing market. Many of our clients choose to work with us at Gallagher because of our connections to various carriers nationwide. Our connections allow us to help our clients find the right carrier and the best coverage for their medical malpractice insurance needs.

Medical Malpractice Insurance Companies in Wisconsin

Since there are many medical malpractice insurance carriers in Wisconsin, you may have trouble selecting the company that is the right fit for you. Many policy buyers are not able to find the best medical malpractice insurance rate by themselves. Working with an advisor like Gallagher allows you to easily choose between the various Wisconsin insurance companies.

Wisconsin Medical Malpractice Insurance Rates by Specialty

Rates are greatly impacted by your specialty. Medical professionals who offer high-risk care like surgery will pay higher rates for medical malpractice insurance than medical professionals who practice in lower-risk areas. Your rate will also vary depending on your location and your claim history. You can consult our experts at Arthur J. Gallagher & Co. to obtain an accurate, specific quote for your medical malpractice insurance.

Why Partner With Gallagher in Wisconsin

When you partner with us at Gallagher in Wisconsin, you can find the right medical malpractice insurance provider and the coverage terms that will meet your insurance needs. With Gallagher, the process of finding and obtaining malpractice coverage can be easy and stress-free. Enjoy the following benefits when you partner with us:

- Multiple accurate quotes: We will provide you accurate quotes from multiple insurance carriers so you can compare your options.

- Top-tier customer service: At Gallagher, our priority is providing our clients with the best possible customer service.

- Custom insurance solution: Our insurance experts will provide a custom insurance solution to meet all your medical malpractice insurance needs.

- Savings: On average, our clients save 20% to 50% when they work with us.

- Favorable terms for coverage: Because of our connections to major providers, we can find you the best terms for medical malpractice coverage.

- Discounts: We will look for discounts you may be eligible for.

We will cover the tasks needed to find the most favorable coverage terms for you. You will have access to experts in medical malpractice coverage in Wisconsin when you partner with Gallagher.

Resources for Physicians in Wisconsin

Gallagher is considered the most trusted, reputable insurance advisor in America today. We have helped physicians across the nation obtain medical malpractice coverage to protect their practice over the long term. With malpractice insurance, you can have peace of mind if a patient files a claim for medical malpractice against you.

We believe in addressing each of your needs by providing Wisconsin medical malpractice insurance that gives you appropriate coverage for the most affordable price. Contact us at Arthur J. Gallagher & Co. to receive quotes for malpractice insurance rates in Wisconsin today.

Wisconsin Medical Malpractice Insurance Rates By Specialty (Top 20)

Rates depend greatly on specialty. Physicians offering high-risk care, such as surgeons, have higher rates than doctors in lower-risk areas. Prices will vary, though, based on your claim history and location in addition to your specialty. Always talk to an insurance expert to get a more specific quote for your malpractice insurance.

Below are undiscounted state filed rate data averages across all territories for 1,000,000/3,000,000 limits.

| Specialty | Average Rate | Lowest Rate | Greatest Rate | Count |

|---|---|---|---|---|

| Family Practice No Surgery | $4,947 | $4,414 | $5,378 | 2,910 |

| Occupational Medicine | $3,832 | $3,090 | $4,306 | 2,548 |

| Internal Medicine No Surgery | $5,381 | $4,935 | $5,696 | 1,930 |

| Pediatrics No Surgery | $4,392 | $3,198 | $5,378 | 933 |

| Anesthesiology | $6,160 | $5,518 | $7,468 | 910 |

| Emergency Medicine | $11,405 | $9,061 | $13,953 | 835 |

| Radiology - Diagnostic | $6,117 | $4,691 | $6,986 | 820 |

| Psychiatry | $3,297 | $2,909 | $3,770 | 697 |

| Obstetrics and Gynecology Major Surgery | $22,038 | $18,765 | $24,403 | 612 |

| General Surgery | $16,025 | $12,427 | $20,462 | 556 |

| Orthopedic Surgery No Spine | $13,537 | $11,693 | $15,311 | 489 |

| Ophthalmology No Surgery | $3,452 | $2,900 | $3,998 | 400 |

| Cardiovascular Disease Minor Surgery | $7,720 | $7,348 | $8,394 | 358 |

| Neurology No Surgery | $6,478 | $5,863 | $7,042 | 291 |

| Gastroenterology No Surgery | $6,086 | $4,496 | $8,261 | 271 |

| Pathology No Surgery | $4,438 | $2,961 | $5,378 | 259 |

| Urology Minor Surgery | $7,089 | $6,324 | $7,870 | 221 |

| Pulmonary Disease No Surgery | $6,108 | $3,967 | $8,261 | 214 |

| Dermatology No Surgery | $3,240 | $2,570 | $3,770 | 204 |

| Otorhinolaryngology Major Surgery | $9,298 | $7,042 | $13,248 | 169 |

* Please note that the above rates are state filed rates. It is not uncommon for Gallagher Healthcare clients to receive up to 50% or more in discounts from state filed rates. Please Request a Quote to receive a custom premium indication.

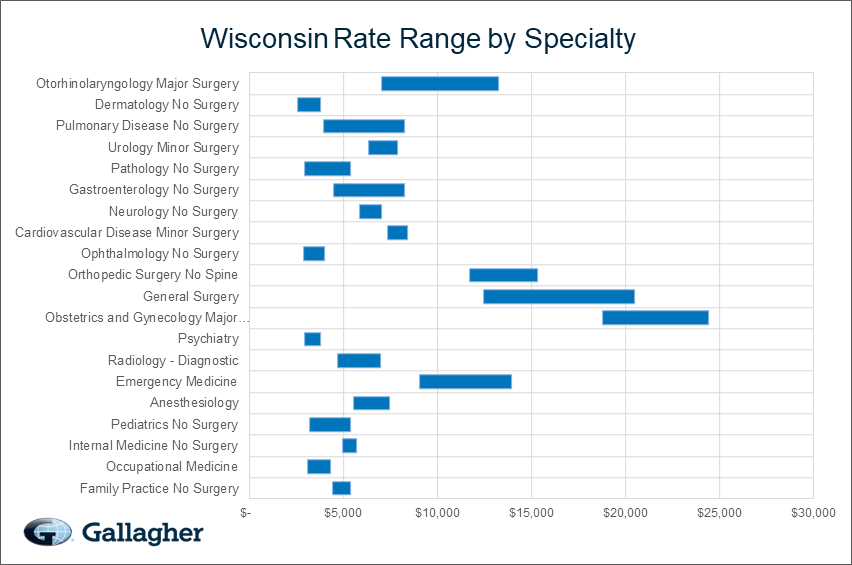

Rate Range by Specialty

This chart compares the range of possible state filed medical malpractice premium rates by admitted markets and a few Gallagher Select markets broken out by the top 20 specialties in Wisconsin.

USA Ranking Map

The map below provides a visual display of the nation and compares what a typical primary care physician might pay compared to each individual state and county. This research is based on the average rate for a single specialty, the most common limits in that state, and the mature claims made premium. The darker the blue, the higher the average premium, see how Wisconsin compares to other states.

Premium savings is just one click away! Complete this form to receive your FREE, NO OBLIGATION medical malpractice insurance quote. You can also call us at 800.634.9513 and ask to speak to a salesperson.